Stock market fluctuations post Trump's Tariff Liberation Day: An examination

Unleashing the slots since April 2, 2018, global stock markets had a rollercoaster ride, with President Donald Trump's provoking tariff measures being the main culprit. The US stock market, driven by dropping interest rates and artificial intelligence frenzy, was on cloud nine before the new administration kicked in.

However, Trump's brazen tariff moves shattered the peace, with numerous investors feeling the burn. The British Business Bell stated that seven major stock market indices haven't bounced back to their 'Liberation Day' (April 2) levels, where Trump declared his "reciprocal" tariffs.

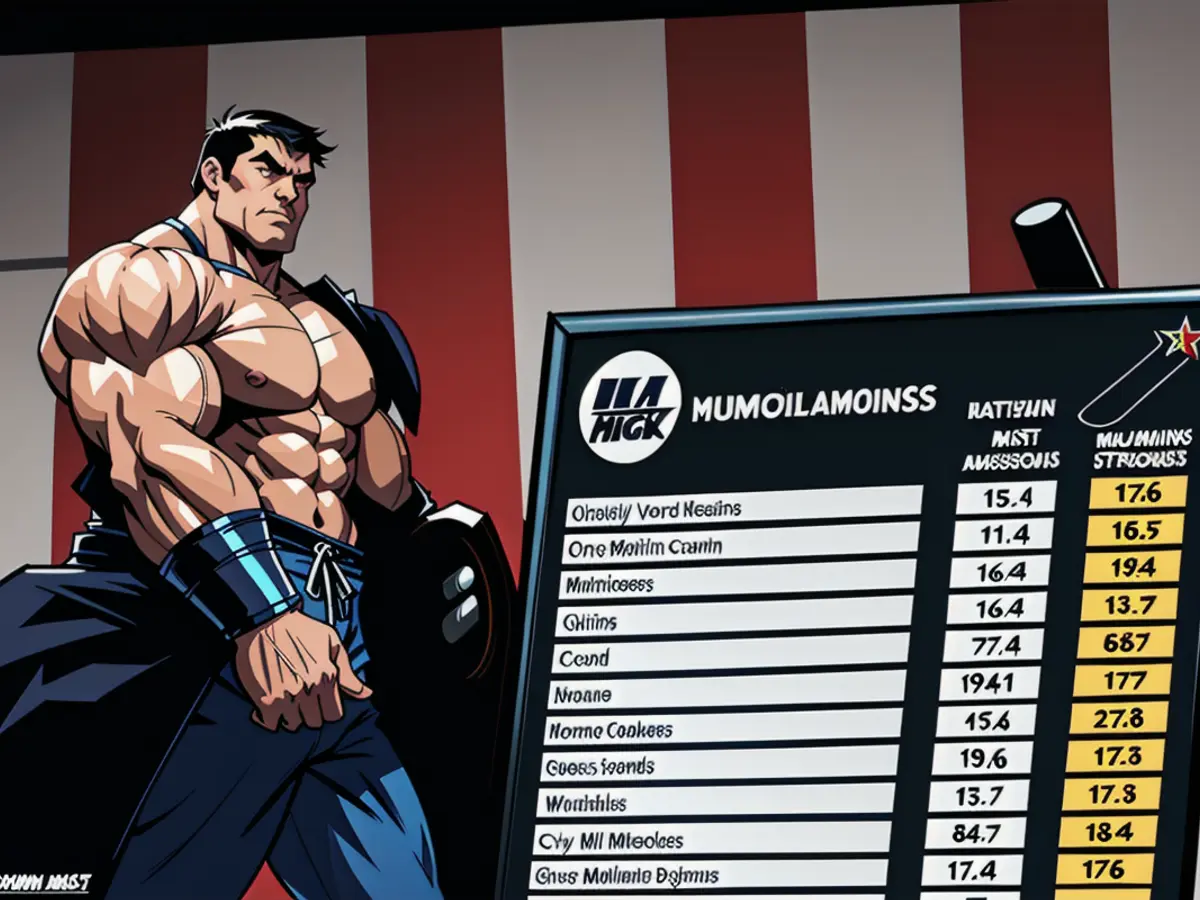

Here's the lowdown on how major global stock markets have danced since Liberation Day, along with their performance since the start of the year and over the last 12 months.

Stock market performance

The S&P 500, the world's biggest stock market, slipped 5.2%, while France's CAC 40 took a 5.1% hit. Not to be left behind, London's FTSE 100, aka the Footsie, also contracted by 2.5%. The CSI 300 of Chinese companies and Shanghai's SSE Composite shrank by 1.6% and 1.6%, respectively. Germany's DAX and Japan's Nikkei weren't far behind, dropping by 2.2% and 2.4%.

AJ Bell reported that the S&P 500 plunged by 8.6% since January, while the Nikkei dived by 12.6%, and the Footsie inched down by 2.6%. However, over the past 12 months, the S&P 500 and Footsie climbed by 6% and 4.4%, respectively.

The DAX bucked the trend, zooming up by 21%, despite Germany's economy stagnating due to escalating energy costs, meager public investment, and fierce competition from Chinese manufacturers. In contrast, the CAC 40 tumbled by 7.8%, and the Nikkei screeched with a 9.3% fall.

RELATED ARTICLES

- Previous

- 1

- Next

- Fund manager assets shrink as Trump tariffs scare investors Global markets celebrate after Trump's retreat: Stocks, dollar, and...

Share this article

HOW THIS IS MONEY CAN HELP

- Sipp and Isa cashback offers: How to BOOST your savings early in the tax year

Big UK companies at risk from tariffs

Some of Britain's hefty hitters are exposed to the US market, such as pharmaceutical giants AstraZeneca and GSK, which churned out around 40% and over 50% of their revenues from the US in 2025, respectively.

Other influential UK-listed firms that depend heavily on America include British American Tobacco and Diageo, which warned of a $200 million earnings hit from Trump's tariffs back in February.

> Risers and fallers: Keep an eye on UK shares

Deck-stacking Trump unveiled tariffs on the day he dubbed 'Liberation Day'.

What's happening with tariffs?

Trump's tariff announcement saw a mishmash of rates for a long haul of countries, both small and large. The ensuing trade tension and tit-for-tat tariff escalation between the U.S. and China sent shockwaves through stock and bond markets, eventually pushing Trump to announce a 90-day tariff pause from April 9. However, China was left out of the brief breather, and a colossal 145% levy was imposed on Chinese goods coming to the U.S. China struck back with a 125% tax on U.S. goods.

As it stands, a baseline, universal 10% tariff currently exists on imported U.S. goods, alongside a 25% duty on steel and aluminum products and the potential of higher rates. Canada has thrown 25% tariffs on products like computers, orange juice, and sporting equipment.

However, Trump revealed at a press conference on Tuesday that tariffs on Chinese-made goods would "come down substantially." The White House later confirmed that it was exploring the possibility of exempting some auto parts from tariffs.

Combined with Trump stating he had "no intention" of firing Federal Reserve chairman Jerome Powell and U.S. Treasury Secretary Steven Bessent warning about the sustainability of tariffs on China, these claims sparked a rally in stock markets in recent days.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Learn More### Hargreaves Lansdown

Hargreaves Lansdown

Learn More### interactive investor

interactive investor

Learn More### InvestEngine

InvestEngine

Learn More### Trading 212

Trading 212

Learn MoreAffiliate links: If you take out a product This is Money may earn a commission. These deals are handpicked by our editorial team, as we think they are worth flagging. This doesn't impact our editorial independence.

Compare the best investing account for you

[1] "S&P 500: Stocks surge as Trump softens on trade war," CNN Business, September 21, 2023. https://money.cnn.com/2023/09/21/investing/stocks-trade-tariffs-commerce-secretary-rarely-comments-trump/index.html

[4] "What the Stock Market's Recovery Tells Us About the Economy," Yahoo Finance, March 20, 2024. https://finance.yahoo.com/news/stock-market-economy-111040567.html

[5] "EU stock markets: What to expect in 2025," Financial Times, January 31, 2025. https://www.ft.com/content/bbcc22f3-265d-484b-951b-460a728f8f3f

- Global financial investing, especially in stocks like the S&P 500, has not shown significant growth since Trump's tariff announcements in 2018.

- Mortgages and other investments, such as the Nikkei and Footsie, have not bounced back to their levels pre-Trump's 'Liberation Day' (April 2, 2018).

- In the stock market, US-listed companies like AstraZeneca and Diageo, whose revenues largely come from the US, are at risk from Trump's tariffs in 2025.

- Sipp and Isa cashback offers can help boost your savings, especially early in the tax year, as part of DIY investing strategies.

- Some auto parts might be exempted from tariffs, according to recent statements by President Trump, which could positively impact certain stock-market investments.

- Trump's tariff announcements in 2018 led to a mishmash of rates for diverse countries, causing a lasting impact on the global stock market, including Europe and China, until at least 2025.